Cleanzine: your weekly cleaning and hygiene industry newsletter 26th June 2025 Issue no. 1168

Cleanzine: your weekly cleaning and hygiene industry newsletter 26th June 2025 Issue no. 1168

Your industry news - first

The original and best - for over 20 years!

We strongly recommend viewing Cleanzine full size in your web browser. Click our masthead above to visit our website version.

Margins remain under pressure in the UK contract cleaning market

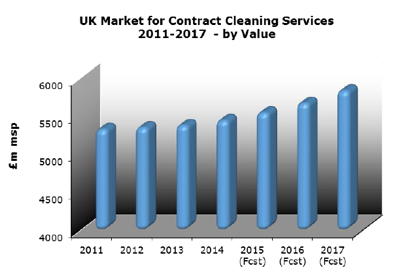

The market for contract cleaning services in the UK has seen low level growth over the past two years and is now worth around £5.5 billion.

The market for contract cleaning services in the UK has seen low level growth over the past two years and is now worth around £5.5 billion.

Though the market was affected by the economic downturn, it has benefited from increased standards in cleanliness demanded by key areas such as health and food hygiene.

Many contract cleaning companies have reported relatively steady growth with further modest growth forecast until 2019 reflecting ongoing recovery in the economy and rising costs.

"Cleaning is one of the most competitive of all contracted-out sectors, with profit margins under constant pressure, though the cleaning & support services industry is generally accepted to be more 'recession proof' than other sectors," says Andrew Hartley, Director of AMA Research, who has produced a new report on the sector which reflects the perceived impact of the incoming Living Wage.

"It is a highly labour-intensive industry and the introduction of the Living Wage with incremental increases is bound to have an impact on the market in the medium term, probably leading to a combination of rising contract values, reduced margins and greater investment in powered cleaning equipment and daytime cleaning."

The report acknowledges that contract cleaning is a mature and highly fragmented market, despite the high level of merger and acquisition activity that seems to have become an ongoing characteristic, and that it is one of the most competitive of all the contracted-out sectors. It says that despite the difficult economic climate over the last five years - and continued cuts across budgets in both the private and public sectors - the market has performed reasonably well compared to the wider facilities management and construction industry. The 'commercial' market (offices, retail etc) is the largest sector with an estimated 43% value share, with local authority and health also representing key sectors.

The UK market for non-domestic cleaning products, including equipment, materials and chemicals, has been largely flat in recent years and only modest growth is forecast for the 2015-2019 period, continues the report. Key trends in this sector include; increasing development of antibacterial products, in particular in the healthcare, food preparation and hospitality sectors, growth in the powered cleaning machine sector, greater focus on improving efficiency and increased automation of cleaning processes, increase in daytime cleaning. The market continues to be strongly driven by legislation and higher standards for cleanliness, hygiene and health and safety.

One of the major issues facing the industry is the recent announcement of the Government's Living Wage, which means that over 25's will receive an hourly wage rate of £7.20 per hour from April 2016 rising to over £9.00 per hour by 2020. While some of these costs will be absorbed, the rise is substantial and will have a major impact on the contract cleaning industry where average pay rates are low and labour costs represent a high proportion of contract prices. This will inevitably drive the market upwards and is also likely to drive growth in the equipment sector as larger employers look to increase productivity levels to offset higher labour costs.

The provision of 'one-stop shop' solutions and bundled services has become an increasingly more attractive option, particularly for larger clients. The economic downturn also increased pressure on companies to improve their operational efficiencies and control costs. It seems likely that demand for bundled services contracts will continue to be a strong driving force in the market over the next few years. It has already become a key factor behind the number of acquisitions of single service providers by FM companies, particularly into specialist sectors such as energy management.

The report adds that in addition, the drive towards more sustainable cleaning practices is a growing issue across the contract cleaning industry, driven by demand from clients keen to ensure that their corporate responsibility towards the sustainability agenda is met. As a result, cleaning firms have introduced a range of new 'green' measures in order to meet this growing area of demand, including daytime cleaning and more energy-efficient cleaning equipment. Daytime cleaning is now becoming more popular where a high standard of cleanliness is required in areas such as healthcare and offices.

The 'Contract Cleaning Market Report - UK 2015-2019 Analysis' report, can be ordered via:

T: 01242 235724

E: [email protected]

W: www.amaresearch.co.uk

1st October 2015