Cleanzine: your weekly cleaning and hygiene industry newsletter 18th April 2024 Issue no. 1110

Cleanzine: your weekly cleaning and hygiene industry newsletter 18th April 2024 Issue no. 1110

Your industry news - first

The original and best - for over 20 years!

We strongly recommend viewing Cleanzine full size in your web browser. Click our masthead above to visit our website version.

Contract Cleaning Market Report - UK 2011-2015 Analysis

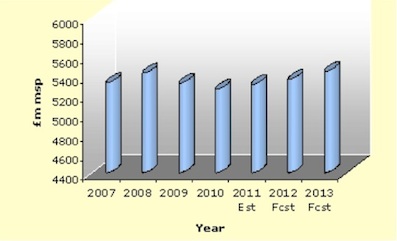

The UK contract cleaning market, which experienced sustained growth to 2008, has experienced a marginal decline of around 3% 2008-10. The market was estimated to be worth around £5.3 billion in 2010 with indications of moderate return to growth in 2011.

Critical factors that have impacted the market in recent years include the effects of the recession, standards of health and cleanliness demanded by key sectors such as health and food hygiene, growth in outsourcing, and strength of the public sector which has helped to buoy the market but has failed to compensate fully for the overall decline.

Other key drivers of growth and change within the sector include daytime cleaning, the environment and sustainability, legislation, technology/new product development, multi-service provision, construction activity and output, PPP and PFI, as well as issues such as staffing, skills and qualifications.

Suppliers' experience of the recession has been mixed, with some companies heavily reliant on just a few major contracts sometimes falling into difficulties, whilst other have reported growth in earnings despite the significant slowdown. Financial pressures in the market, as a result of intense competition and pressure on margins, has also limited the ability of organisations to invest in new equipment and technology, training and the appointment of new staff.

The market for non-domestic cleaning equipment, materials and chemicals covers a wide variety of products which, in some cases, are sold into both the domestic and non-domestic markets. Market value reached an estimated £1 billion in 2010 having experience more difficult conditions from 2007 onwards, although there has been evidence of slight improvement in 2010 in some sectors.

The upturn in sales has been triggered in part by slight improvements in the underlying economy as well as by higher levels of outsourcing on the part of the public sector, with the latter driving machinery and other product sales to newly outsourced contracts.

In the medium to longer term, however, public sector cuts are expected to negatively affect growth. Current forecasts indicate that the contract cleaning market is expected to show only marginal growth in 2011 with value of around £5.3 billion. Prospects into the medium-term are for further moderate rates of annual growth to 2015 when the market is forecast to reach around £5.7billion.

Key to this forecast remains the influence of FM and outsourcing of contracts within the market. In the current climate, many FM contracts have been renegotiated - particularly in the public sector - to generate savings in long term contracts, with cleaning budgets likely to be under pressure.

The overall market is likely to be affected by the balance between the pace of recovery in key private commercial sectors offset by central government and local authority budget cuts into the medium-term. Government spending cuts may have some positive effects on contract cleaning and facilities management, with local authorities opting for bundled service outsourcing contracts rather than single contracts, in order to reduce the number of suppliers and cut costs.

'Contract Cleaning Market Report - UK 2011 - 2015 Analysis' is available in hard copy or electronic format and can be ordered at :

T: +44 (0)1242 235724

F: +44 (0)1242 262948

E: [email protected]

W: www.amaresearch.co.uk

28th July 2011