Cleanzine: your weekly cleaning and hygiene industry newsletter 3rd July 2025 Issue no. 1169

Cleanzine: your weekly cleaning and hygiene industry newsletter 3rd July 2025 Issue no. 1169

Your industry news - first

The original and best - for over 20 years!

We strongly recommend viewing Cleanzine full size in your web browser. Click our masthead above to visit our website version.

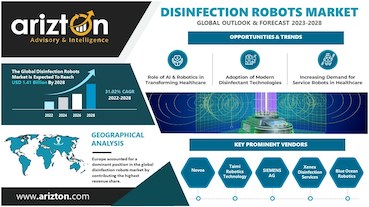

Global disinfection robots market booms as demand soars, triggering innovation & strategic investments

According to Arizton's latest research report, the disinfection robots market will increase at a Compound Annual Growth Rate of 31.02% from 2022 to 2028.

According to Arizton's latest research report, the disinfection robots market will increase at a Compound Annual Growth Rate of 31.02% from 2022 to 2028.

The evolution of automated guided vehicles & automated mobile robots, innovative patented technologies & large supply contracts, funding & investments for developing disinfection robots, advancement of new electric disinfection robots, government & non-government initiatives for environmental protection and demand for energy-efficient disinfection robots are significant trends in the disinfection robots industry.

Key questions answered in the report include:

- How big is the disinfection robots market?

- What is the growth rate of the global disinfection robots market?

- Which region dominates the global disinfection robots market share?

- What are the significant trends in the disinfection robots industry?

- Who are the key players in the global disinfection robot market?

Evolution of Automated Guided Vehicles & Automated Mobile Robots uplifting the market opportunities

The 399-page report recognises that automated mobile robots (AMR) are used for cleaning and disinfection in distribution centres, hospitality services, grocery stores, hospitals, healthcare facilities and more, saying that the need for cleanliness and hygiene has become crucial due to Covid-19. It says that AMRs offer a cost-effective way of achieving this by deploying automated cleaning & disinfection equipment wherever needed.

It goes on to explain that an autonomous cleaning robot removes visible dirt and can apply disinfectants for effective sanitisation, saying that some are fitted with spraying devices for disinfection of surfaces above floor level, and that a UVC disinfection robot is a type of AMR equipped with a UVC emitter suitable for disinfecting environments to eradicate bacteria and viruses.

Automated guided vehicles (AGV), it says, are being challenged by the more sophisticated, flexible and cost-effective technology of AMRs, and that although an AMR has much more advanced technology than an AGV, it is typically a less expensive solution. An AMR does not need wires, magnetic stripes, or other costly modifications. Therefore, it is faster and less expensive to get AMRs up and running, with no expensive disruption to production during the process. AMRs are highly flexible, which is crucial for modern manufacturing environments requiring agility and flexibility in case of product modifications or production lines. Recently, AMRs have been highly deployed into disinfecting robots, thereby contributing to the market's growth.

The aggressive adoption of disinfection robots has increased demand and new large-scale investments worldwide, propelling the market. Across the board, such robots were deployed widely before the pandemic, followed by existing robotic platforms that can be adapted readily to address the most pressing current needs.

Since existing platforms cater to the current demands, making investments will result in developing systems ready for future crises.

Also, most companies are focusing on product line expansion to include disinfection robots integrating improved autonomous capabilities compared to existing products. Several companies are investing while supporting the robotic industry, providing greater control in shaping the future.

Such investments mainly serve the pandemic response and post-pandemic recovery in various countries. One such investment was made recently by Robert Wood Johnson University Hospital in Tru-D, a UVC disinfection robot that protects patients and staff from harmful pathogens.

Surging demand for disinfection robots takes centre stage in hospitals across APAC, Middle East, and Africa-

The demand for advanced and efficient patient care in major emerging economies is expected to help construct new hospitals, says the report. Most hospital management and government facilities have implemented stringent norms to ensure that all hospital premises are microbe-free. The threat of disease and growing deaths, especially due to infectious diseases, has led several emerging economies to increase concerns over installing disinfection robots in each part of the hospital building.

Most countries in APAC and North America have implemented stringent norms to ensure safety in maintaining air quality and made indoor disinfection robot applications mandatory in hospital buildings.

Healthcare spending is expected to be bolstered by factors such as growing and aging populations, advances in clinical technology, and market expansion.

Major companies offering disinfection robots witnessed massive demand for their products to deploy in healthcare settings. UVD Robots, part of Blue Ocean Robotics, signed an agreement with Sunay Healthcare Supply to ship its disinfection robots to several hospitals in China. A Shanghai enterprise, Taimi Robotics Technology, designed and produced over 30 disinfection robots that entered major hospitals in Wuhan. Shenzhen-based Pudu Technology also deployed its disinfection robots in more than 40 hospitals around China. Xenex Disinfection Service, a leading provider of disinfection robots, has already deployed its robots in more than 500 hospitals across the UK, Europe, South America, Asia, the Middle East and Africa.

Such instances increase the demand for disinfection robots in healthcare facilities and contribute to market growth.

Profiles of some 50 market players are covered in the report, while products and technologies include:

- Hydrogen peroxide vapor disinfection robots

- UV disinfection robots

- Disinfection spray robots

- Combined system robots

- Technology type - fully autonomous robot / semi-autonomous robot

- Sensor type - ultrasonic sensor / infrared sensor

- Controller type - wi-fi controller / bluetooth controller

4th January 2024