Cleanzine: your weekly cleaning and hygiene industry newsletter 18th April 2024 Issue no. 1110

Cleanzine: your weekly cleaning and hygiene industry newsletter 18th April 2024 Issue no. 1110

Your industry news - first

The original and best - for over 20 years!

We strongly recommend viewing Cleanzine full size in your web browser. Click our masthead above to visit our website version.

Soapbox: Employment growth drives UK employment rate to record high while pay growth remains relatively sluggish for the majority

Gerwyn Davies, Labour Market Adviser at the Chartered Institute of Personnel & Development, the professional body for HR and people development, comments on the official labour market statistics published this week by the Office for National Statistics:

Gerwyn Davies, Labour Market Adviser at the Chartered Institute of Personnel & Development, the professional body for HR and people development, comments on the official labour market statistics published this week by the Office for National Statistics:

"Employers' appetite for taking on workers shows no sign of abating. This is reflected by the record number of people aged 16-24 in work. Apart from the modest increase in redundancies, all of the employment indicators are moving in the same positive direction.

It's good to see that more people are getting into work but the focus must now shift to what is happening to those people once they are in work. Skills shortages and utilisation is still a major problem in many businesses. If we are to improve overall UK productivity, we must lift up the bonnet on British businesses and take a look at what they are doing to develop and use their people's skills. Until this issue is tackled, performance and pay will continue to suffer.

"This is reflected in the fact that pay growth remains static for the majority of workers. Earnings including bonuses may have risen, but this is largely due to the bonuses being more prevalent in sectors such as finance. Meanwhile, the basic pay measure has fallen modestly compared with last month.

As our own Labour Market Outlook indicated earlier this week, a tale of two workforces is emerging. Some employees are comfortably exceeding the cost of living in their pay packets and others aren't getting a pay rise at all. It's no surprise to see pay growth remain so stubborn given current productivity levels and the increased supply of workers, especially older workers and EU migrants. As the figures show, economic migrants make up around 40% of employment growth during the past year, driven by an increase of around 25% EU8* migrants in employment."

Note - * EU8 refers to the 2004 accession countries - who joined the EU in 2004 (Poland, Hungary, the Czech Republic, Slovenia, Slovakia, Estonia, Lithuania, and Latvia

Key findings from the latest CIPD Labour Market Outlook include:

- The report highlights an increasing pay divide between companies that can now afford to increase wages by 2% or more and those that are stuck in a pay freeze.

- The latest Labour Market Outlook highlights how almost half of the UK workforce has seen either a pay freeze or a pay cut (3% pay cut, 39% pay freeze) in the 12 months to December 2014. In contrast, a similar proportion (40%) have received a pay increase of 2% or more and less than a fifth (18%) fall in the middle ground of people who have received a pay increase in the 0.1-1.99% corridor

- Almost half of private sector firms (48%) said that they gave a basic pay increase of at least 2% during the same period, including more than half of manufacturing and production firms (54%). However, during the same period, more than a third of manufacturing and production firms (35%) froze pay.

- Meanwhile, the services sector portrays a very similar hour-glass figure in terms of the distribution of basic pay awards. While almost half of services companies (47%) awarded a basic pay increase of 2% or more in the 12 months to December 2014, more than a third (35%) imposed a pay freeze.

- Evidence in our report shows a clear correlation between employers that state they have adopted a high value business strategy (as opposed to a low cost strategy) and those that were able to afford to pay a pay increase of 2% or more.

- The report implies that the difference within sectors between companies that can afford to pay a decent pay rise and those that are continuing to freeze pay lies partly in the quality of leadership and management and level of workforce investment. There is evidence that organisations that have more sophisticated product market strategies are more likely to have adopted more advanced human resource management strategies characterised by more progressive people practices and greater workforce investment. Therefore, the role for government is not to cajole business into giving more generous pay awards on the back of stronger economic growth and lower costs, but to understand the levers that can help more firms increase their workplace productivity and move up the quality chain. This includes supporting businesses to improve management practices and encouraging greater investment in skills and the effective utilisation of skills.

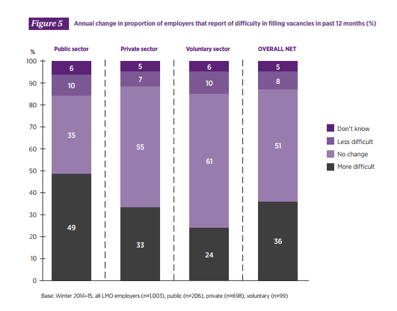

The Labour Market Outlook also suggests that employment confidence is set to remain strong over the next three months, although there has been a sharp drop in confidence in manufacturing. Private sector firms will continue to drive most of the jobs growth, and there was a particularly robust performance from the financial sector.

The full report can be found at:

19th February 2015